Tax Notice

Tax Notice is a letter sent from Internal Revenue Service (IRS) to the taxpayer for tax related issues. In general, the tax notice is time sensitive letter that requires your response. If you receive notice from the IRS, the Ivy Tax & Business will explain you the reason of the notice and will guide you how to tackle the situation. Please feel free to contact us to help resolve your tax concerns.

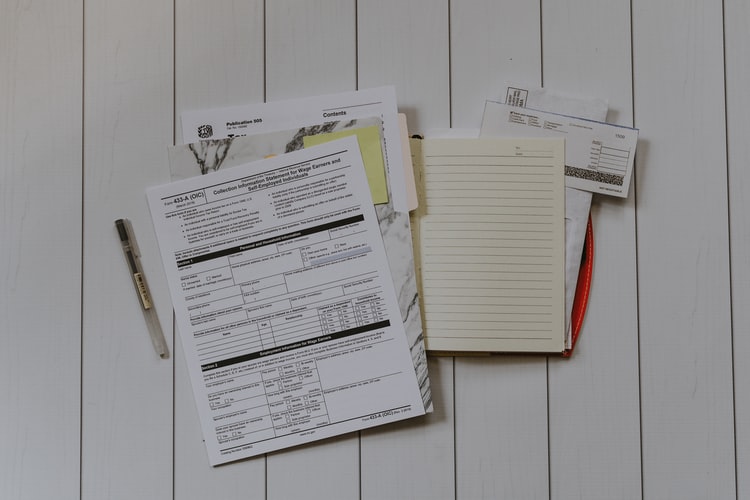

Tax Audit

A tax audit is the examination by the Internal Revenue Service (IRS) to check whether the information provided on the tax returns is accurate or not. Tax audit is usually questioning your income and deduction from your tax return. IRS always notify you by mail.

The reason why CPA is needed

Please Take Tax Notice & Audit Seriously. You typically have limited time, usually 30 days to response the Tax Notice or audit. IRS has right to levy your personal property to satisfy tax debt. The best option is to hire qualified and experienced CPA professionals to handle your tax notice & audit. We know the best way to deal with the IRS. We can help you to resolve the matters with IRS quickly and in effective way.